Built for Revenue.

Powered by AI.

Enterprise software infrastructure for modern lending.

Our flagship platform, aliyaOS™, transforms how banks lend by turning fragmented processes into a single, fully autonomous system that integrates data, decisioning, risk management, and capital markets.

aliyaOS™ operates 24/7 with zero human intervention, helping financial institutions grow deposits, reduce losses, and scale lending profitably — with enterprise-grade governance.

LIVE with a top 5 U.S. Bank since 2018.

AI that Automates, Engages, and Generates Revenue.

5%

ROA yields

~13%

Yields

net of losses

90%

Reduction in

cost-to-serve

96%

Loans fund in under 60 minutes

Deposit Growth &

Customer Engagement

Turn everyday banking data into personalized credit offers that build stickier relationships and deeper wallet share.

aliyaOS™ uses cash-flow intelligence to target and engage customers — growing deposits through lending.

Risk-Controlled

Earnings Growth

Our models deliver 40–50% lower loss rates through real-time pricing and cashflow-based underwriting.

Operational Efficiency

at Scale

Live in 12–16 weeks, aliyaOS™ automates decisioning, fulfillment, and capital allocation, with no core system integration required.

Deploy a fully digital, agentic lending operation that cuts cost-to-serve by up to 90%.

The Future of Lending is Agentic.

A fully autonomous lending system built for risk, scale, and profitability.

aliyaOS™ transforms raw customer data — from DDA transactions to credit histories — into dynamic, risk-first lending. It unifies the full lending lifecycle: data capture, decisioning, offer construction, fulfillment, risk oversight, marketing, and capital optimization.

Every step is orchestrated through a single agentic workflow — delivering instant decisions, same-day funding, and stable returns.

Full regulatory compliance

Always-on operations

Autonomous profitability

Proven Results. Measurable ROI. Real-World Scale.

| 5%+ ROA | Higher-yielding portfolios via precise, risk-based pricing |

| ± 13% net yields | After loss performance on unsecured credit |

| 50% lower losses | Driven by cashflow-based risk segmentation |

| 2–3% cumulative losses | On personal and SMB loans decisioned with aliyaOS™ |

| 90% lower production costs | Full digital automation across origination |

| <5 min application to close | Includes instant decisioning and auto-funding |

| $30B+ loans decisioned | At scale, under OCC-grade model governance |

This isn’t theoretical AI.

It’s live infrastructure running inside a U.S. mega bank since 2018

Built for

Enterprise.

Enterprise-grade governance, scale, and compliance.

Driven by intelligence.

Real-time, data-first decisioning across the lending lifecycle.

Designed

for precision.

High-fidelity model. Risk-first pricing. Instant fulfillment.

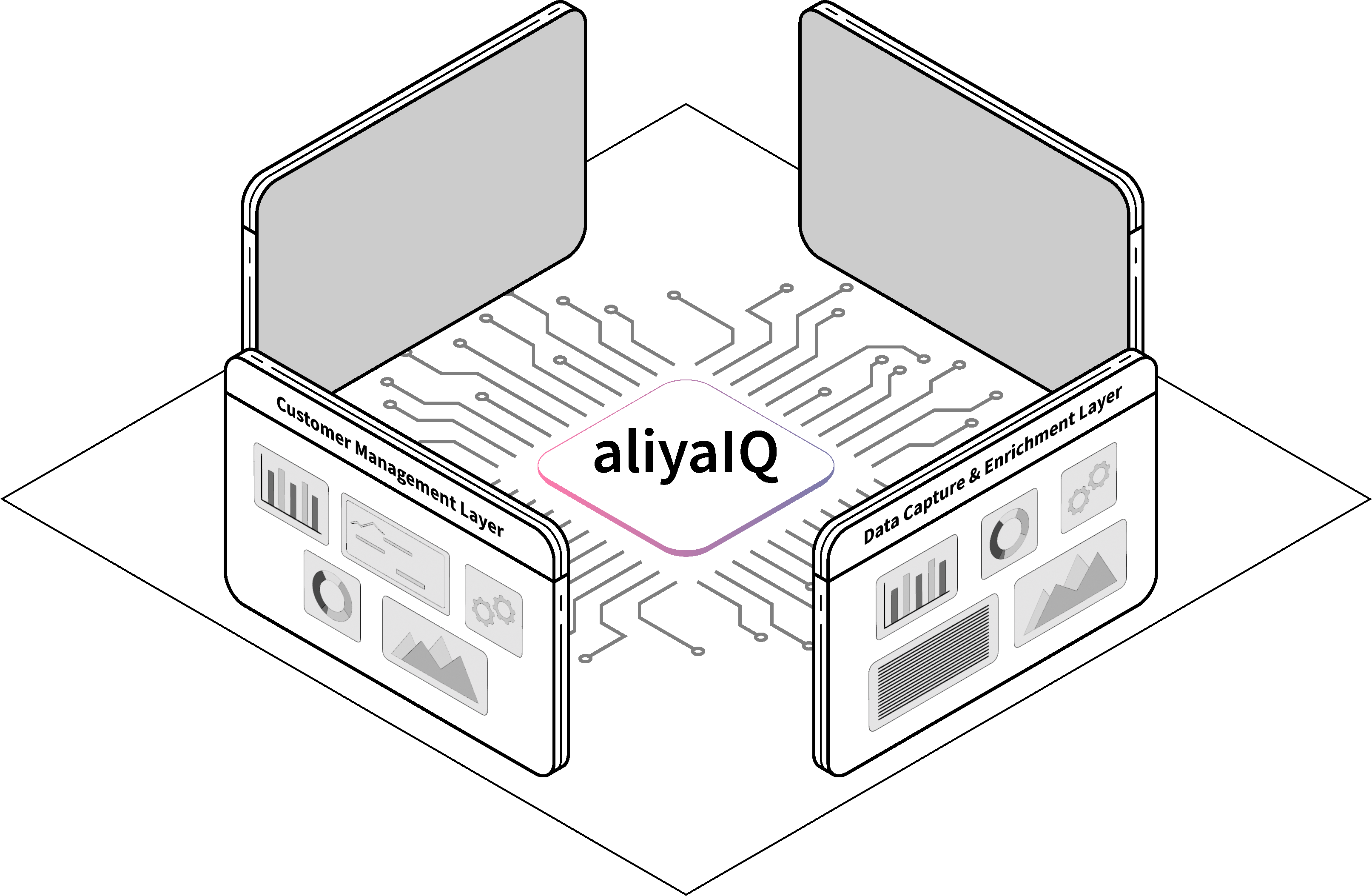

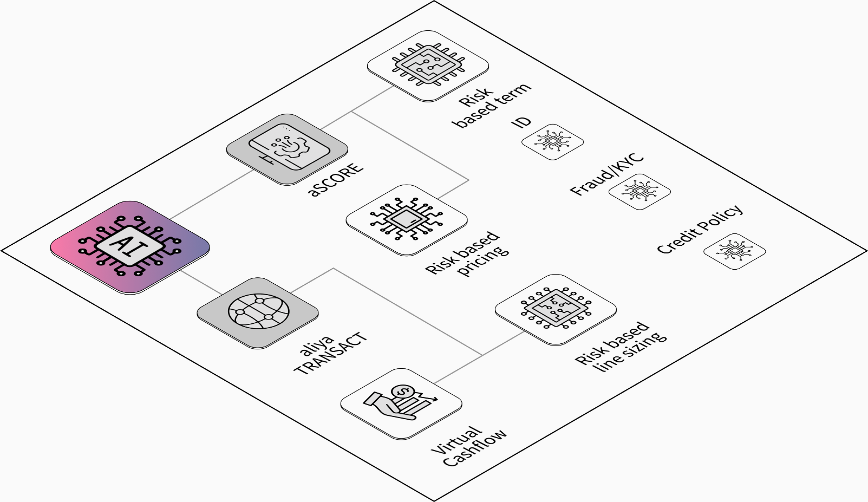

What powers aliyaOS™

Data Capture & Security

aliyaOS™ ingests and enriches data from DDA accounts, credit bureaus, and third-party and government sources — all within an infrastructure built for data security and regulatory compliance.

- SOC 1 & 2 (Type II), ISO 27001 certified

- Data encrypted at rest and in transit

- Proactive threat detection and 24/7 monitoring

- Expert InfoSec team and secure cloud architecture

Intelligence

Aliya’s AI engine leverages proprietary models built on over 1.2 trillion transactions and $30B+ in loan decisions.

- aSCORE™ credit model outperforms FICO by up to 91% (prime) and 54% (mid-tier)

- aliyaTRANSACT™ cashflow analysis engine with 99.9% categorization accuracy

- Real-time, transaction-level affordability insights

- Dynamic, policy-aligned risk-based pricing

- Reduces exposure-at-default by up to 50%

Customer & Capital Management

From application to funding to syndication, aliyaOS™ delivers a frictionless, fully digital lending experience.

- Instant decisioning with automated booking and same-day funding

- One-click applications with real-time income verification

- Omni-channel prescreening and smart marketing “nudges”

- Direct capital syndication via Figure Connect™ blockchain platform

- Balance sheet optimization and fee income generation

Command & Control

aliyaIQ™ is the AI-powered control center behind every loan. It continuously optimizes marketing, pricing, and risk based on:

- Target customer cohorts

- Capital availability

- Risk-adjusted return thresholds

- Post-origination risk signals

- Capital market conditions

From acquisition through repayment, aliyaIQ™ delivers full transparency and control.

One Intelligent Workflow. No Human Handoff.

From borrower intake to credit decision, funding to syndication, and performance oversight — aliyaOS™ orchestrates every function in the lending lifecycle. One ‘always on’ system. Zero manual work. No disconnected tools.

Deploy in Weeks.

No Core System Integration Required.

Aliya’s plug-and-play platform is built to deploy fast and scale securely.

From onboarding through workflow design to go-live, the system can be operational in under four months with full support across risk, compliance, and technology teams.

Built for Trust. Compliant by Design.

aliyaOS™ meets the most rigorous global standards for data protection, availability, and privacy to ensure every decision is secure, auditable, and compliant.

From infrastructure to daily operations, security is foundational to aliyaOS™. We align with leading regulatory frameworks, maintain strict internal controls, and proactively manage risk across every layer in the system.

SOC 1 Type II and SOC 2 Type II

- aliyaOS’s infrastructure, applications and operations were developed to comply and align with the most rigorous legal and regulatory requirements in industries today.

- We adhere to the stringent SSAE 18/ISAE 3000 Service Organization Control (SOC), SOC 1 and SOC 2 security frameworks, ensuring that data security and availability, processing capacity, confidentiality and privacy are all rigorously maintained.

ISO 27001

Our International Organization for Standardization (ISO) 27001 certification reflects our commitment to maintaining a formal Information Security Management System (ISMS) that safeguards the security and availability of client data within our platform and application. The ISO 27001 means that we follow internationally recognized best practices and principles in place to govern and secure your data.

Data Encryption

aliyaOS uses strong encryption of all data, both in transit and at rest –your data remains encrypted at all times in our environment. While our cloud providers host our data, they do not have access to it. Further, our cloud providers and their processes are fully compliant with SOC and PCI DSS certifications.

Threat Detection

We protect your data with state-of-the-art tools and products, including web application firewalls, intrusion detection, anti-malware, two-factor authentication, file integrity monitoring, threat evaluation and risk management tools. We continuously monitor the security of our environment, with processes designed to proactively mitigate risks up front and handle vulnerabilities on an ongoing basis.

Information Security

Aliya’s InfoSec team is led by industry experts, and our entire company is trained in security and data protection. Security is a cornerstone of our daily operating environment, where our personnel are an integrated component in the overall security team, ensuring a secure and compliant environment for hosting client data, including PII.

Download our whitepaper.