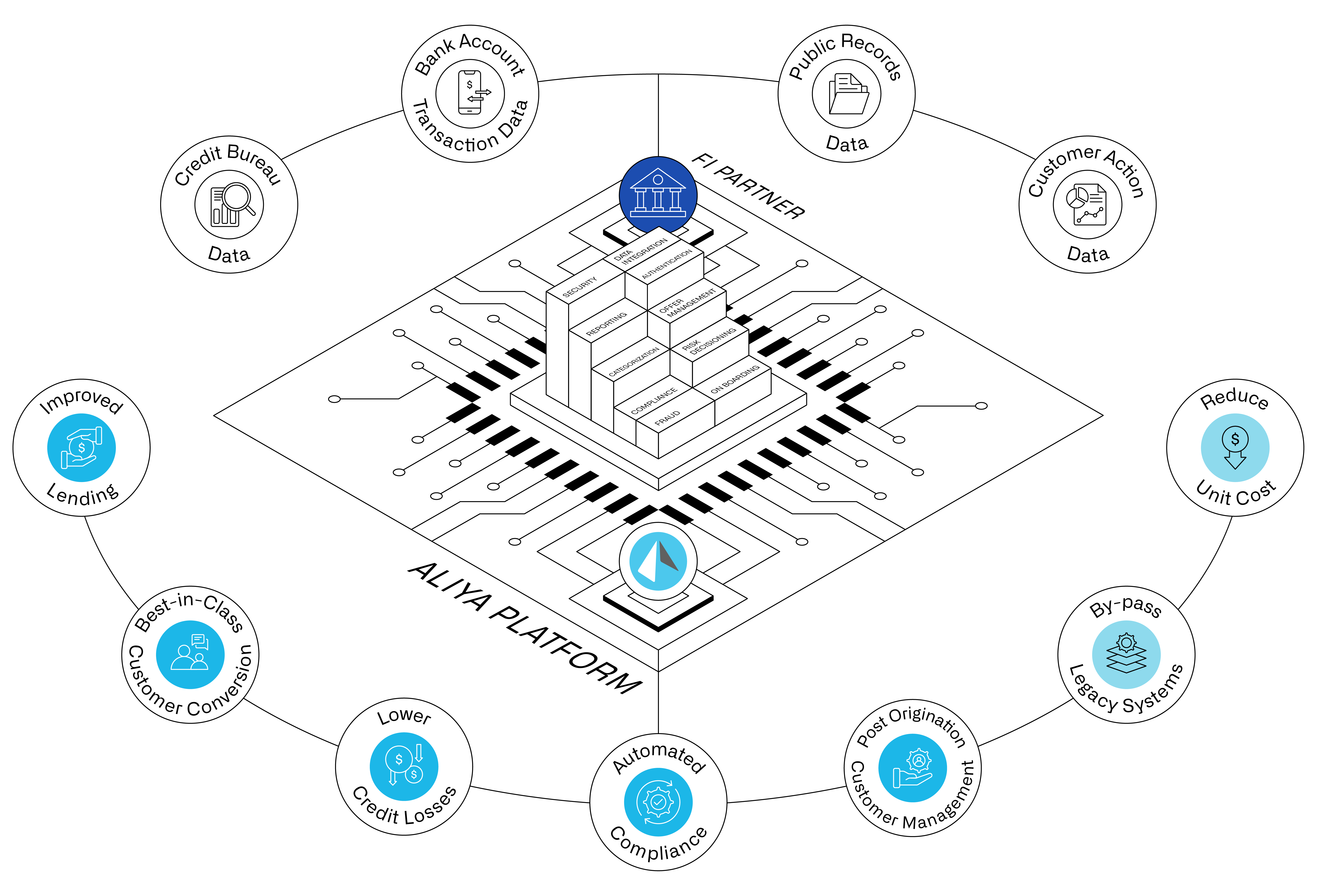

Aliya’s platform is a powerful AI system designed to drive top-line growth, reduce loss rates and transform the customer experience, while bypassing legacy processes and infrastructure.

Lenders cannot settle for marginal improvements in an era where smartphones are a thousand times more powerful than mainframe computers from a decade ago and customers expect more.

01/ Faster Decisions. Increase Acceptance.

02/ Reduce Risk.

03/ Proven Regulatory Governance and Compliance.

04/ Fast Deployment. No Technical Integration.

05/ Proven Track Record - $10 Billion Decisioned at Top 5 US Bank.

US mega bank has used Aliya's Al to decision over $10 billion in unsecured loans.

More compliant, profitable, flexible and inclusive lending.

Standardizes and categorizes demand deposit account (DDA) data and card transactions to generate "virtual profit and loss" statement and insights into income patterns, spending behaviors and cash flow. No need to upload dated information such as tax forms, paystubs, financial and bank statements, etc.

Combined with credit bureau data to assign a proprietary aSCORE (Aliya's credit default model) to generate an instant loan offer.

Cutting-edge digitization and Al-powered automation, with the goal of human intervention on a management-by-exception basis.

An e-commerce style interface allows applicants to close loans in as few as four screens, resulting in higher closing rates - positive selection bias.

Proven and tested policies and documentation: plug-n-play model risk governance documentation, credit policies, loan agreements and requisite policies and procedures to support your lending program.

Aliya fulfills US mega-bank grade requirements at all phases.

Cloud agnostic and on-prem solutions.

Immediately deployable platform designed to bypass current infrastructure and processes.

Go-live in 30-60 days.

Standardizes and categorizes demand deposit account (DDA) data and card transactions to generate "virtual profit and loss" statement and insights into income patterns, spending behaviors and cash flow. No need for upload dated information such as - i.e. tax forms, paystubs, financial and bank statements, etc.

Combined with credit bureau data to assign a proprietary aSCORE (Aliya's credit default model) to generate an instant loan offer.

Cutting-edge digitization and Al-powered automation, with the goal of human intervention on a management-by-exception basis.

An E-commerce style interface allows applicants to close loans in as few as four screens, resulting in higher closing rates - positive selection bias.

Proven and tested policies and documentation:plug-n-play model risk governance documentation, credit policies, loan agreements and requisite policies and procedures to support a lending program.

We fulfill US mega bank grade requirements at all phases.

Cloud agnostic and on-prem solutions.

Immediately deployable platform designed to bypass current infrustructure and processes.

Go-live in 30-60 days.

Our cloud platform's infrastructure, applications and operations have been developed to comply and align with some of the most rigorous legal and regulatory requirements in industries today.

We adhere to the stringent SSAE 18/ISAE 3000 Service Organization Control (SOC), SOC 1 and SOC 2 security frameworks, ensuring that data security, data availability, processing capacity, confidentiality and privacy are all rigorously maintained.

The International Organization for Standardization (ISO) 27001 certification reflects our commitment to a formal Information Security Management System (ISMS) to effectively manage the security and availability of client data within our platform and application. The ISO 27001 means that we have best practices and principles in place to govern and secure your data.

Our platform uses strong encryption of all data, both in transit and at rest, so that your data is encrypted at all times in our environment. Our cloud providers host our data but do not have access to it. Further, our cloud providers and their processes are fully compliant with their own SOC and PCI DSS certifications.

We use state-of-the-art tools and products to secure your data, including web application firewalls, intrusion detection, anti-malware, two-factor authentication, file integrity monitoring, threat evaluation and risk management tools. We monitor all security aspects of our environment, with processes designed to mitigate risks up front and handle vulnerabilities on an ongoing basis.

Aliya’s InfoSec team is led by industry experts and our entire company is trained in security and data protection. Security is a cornerstone of our daily operating environment, where our personnel are an integrated component in the overall security team, ensuring a secure and compliant environment for hosting client data, including PII.

Our cloud platform's infrastructure, applications, and operations have been developed to comply and align with some of the most rigorous legal and regulatory requirements in industries today.

We adhere to both of the stringent SSAE 18/ ISAE 3000 Service Organization Control (SOC), SOC 1 and SOC 2 security frameworks, ensuring that data security, data availability, processing capacity, confidentiality, and privacy are all rigorously maintained.

The International Organization for Standardization (ISO) 27001 certification reflects our commitment to a formal Information Security Management System (ISMS) to effectively manage the security and availability of client data within the platform and application. The ISO 27001 means that we have best practices and principles in place to govern and secure your data.

Our platform uses strong encryption of all data, both in transit and at rest, so that your data is encrypted at all times in our environment. Our cloud providers host our data, but do not have access to it. Further, our cloud providers and their processes, are fully compliant with their own high quality SOC and PCI DSS certifications.

We use state of the art tools and products to secure your data, including web application firewall, intrusion detection, anti-malware, two factor authentication, file integrity monitoring, threat evaluation, and risk management tools. We monitor all security aspects of our environment, with processes designed to mitigate risks up front, and handle vulnerabilities on an ongoing basis.

Our InfoSec team is led by industry experts. Further, the entire company is trained in security and data protection. Security is a cornerstone of our daily operating environment, where our personnel are an integrated component in the overall security team, contributing to securing your data, and maintaining a safe and compliance environment to host client data including PIl.

Proven technology. Proven business results. Proven regulatory governance and compliance. Rapid deployment.

The days of low interest rates are decidedly over and banking needs to adapt.

Aliya Founder and CEO S.P. "Wije" Wijegoonaratna joins Head of Solutions Consulting at MX, Charles Sweeney for a wide ranging discussion and Q&A.

Bankers should think outside of the box if they are to better serve their customers and the capabilities to do this are already in place.

Aliya was founded in 2016 and collaborated with one of the five biggest banks in the US to build well-governed and compliant AI-powered risk and intelligence models.

Aliya's Al has been subject to rigorous model risk governance processes and has supported more than $10 billion in consumer and SMB credit decisions.

At Aliya we believe human ingenuity, combined with data-science driven intelligence, produces transformative business solutions that go beyond our imagination today.

We Empower Financial Institutions To Better Serve Customers Through Increased Lending, Greater Financial Inclusion and an Elevated Customer Experience

For whistle-blower reporting, email us at the following address:

Your email will be treated confidentially. You can perform this email anonymously. You could perform this from an email ID that you might temporarily create on gmail or similar.